Taiwan’s exporters are feeling the pain of China’s economic weakness, with the global slowdown and escalating geopolitical tensions also taking their toll on Asian tech powerhouse.

In a sign of the waning demand, Taiwan export orders plateaued in August from July, with the almost $55 billion in new orders down 20% from the peak in December last year. Orders are a leading indicator of future demand, and the more than 25% drop in orders from mainland China and Hong Kong last month indicate that exports and company revenue are likely to continue weakening.

Some of Taiwan’s biggest companies, from iPhone maker Hon Hai Precision Industry Co. to food and beverage giant Want Want China Holdings, have flagged growth concerns this year when reporting profits, citing problems like supply chain bottlenecks in China and slower demand. That cautious outlook is a sign that the global slowdown is starting to have real-world impact in places like Taiwan, which plays a key role in the world’s semiconductor supply chain and had benefited from two years of pandemic-induced demand.

“If China’s economy remains sluggish and reopening in China keeps on being postponed, that is a very significant pressure on Taiwan’s trade side,” said Ma Tieying, an economist at DBS Group Holdings Ltd. “In terms of electronics, chemicals, commodities-related sectors, the dependence ratio on China’s market is still pretty high for Taiwan’s exports.”

Mainland China and Hong Kong together take around 40% of the island’s exports. Even though China showed some signs of a pickup in August, the economy is struggling, weighed down by Covid Zero policies which have undercut domestic spending and incomes, a housing slump which has hit industrial demand, slowing export growth, and also temporary factors such as a heatwave and power shortages over the summer.

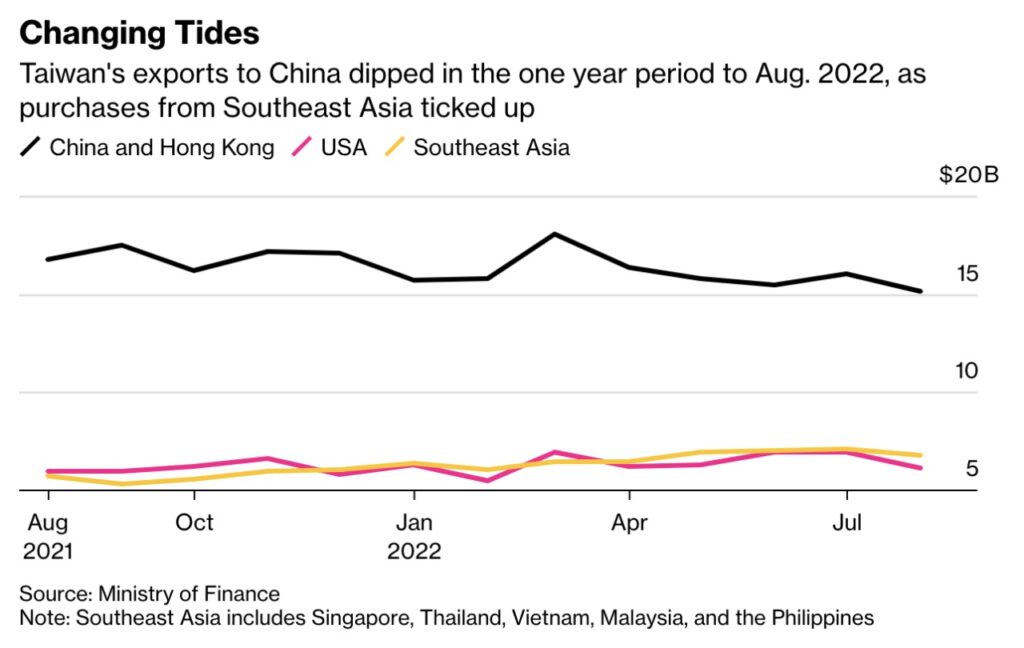

Changing Tides

Taiwan’s exports to China dipped in the one year period to Aug. 2022, as purchases from Southeast Asia ticked up

Source: Ministry of Finance

Note: Southeast Asia includes Singapore, Thailand, Vietnam, Malaysia, and the Philippines

Taiwan’s trade with the mainland is dominated by electrical equipment and chips components, and its companies, notably its biggest chip-maker Taiwan Semiconductor Manufacturing Co., also operate factories on the mainland. However demand for those products is falling in China, with mobile phone output dropping 8% in August and computer production falling by almost 19% from a year earlier.

Hon Hai posted better-than-expected net income earlier this year, but its chairman Liu Young-way said the company would need to “pay close attention to the development of geopolitics, inflation, and the pandemic” in the second half of this year.

Growth Boost

Strong exports helped support Taiwan’s economic growth last year even as domestic consumption took a hit during the pandemic. However as exports this year have slowed, the contribution to overall growth has dropped to less than 3% in the second quarter, compared to nearly 13% the year before.

Falling Fortunes

Taiwan’s exports contributed less to the island’s economic growth in 2022, as sluggish demand has taken its toll

Overseas shipments have also been hurt by global inflation, rising interest rates, and Russia’s war in Ukraine, which have have cut into demand from US and Europe, said Beatrice Tsai, chief statistician of the Ministry of Finance. While there was still demand for electronic components, more than half of the island’s major export categories — including plastics and base metals — declined for the first time in two years, she told reporters earlier this month.

Exports in August grew only 2% from the year before, which was the slowest pace of growth since July 2020, but they may shrink by as much as 3% this month, according to Tsai. Further interest rate increases in the US are also likely to hit export demand, with growth already slowing to just 2.3% in August from the double-digit expansions seen in the previous 19 straight months.

The economy and trade are also facing growing geopolitical risks, with Beijing halting some trade in apparent retaliation for US House Speaker Nancy Pelosi’s August visit to the island. While the amount is small now, there are concerns that intensifying cross-strait tensions could lead to more damaging measures targeting Taiwanese wood, minerals, or even electronic components.

In further signs of the downturn, Taiwan’s manufacturing index has contracted for three consecutive months, falling in August to 42.6 points — its lowest reading since May 2020. The economy’s industrial output growth slowed in July to 1.1% and is forecast to have slowed even more in August.

Taiwan’s government has for years sought to reduce its economic reliance on China for political reasons and since the beginning of this year there has been some diversion of Taiwanese exports to Southeast Asia, according to Darson Chiu, research fellow at the Taiwan Institute of Economic Research. Countries from the Association of Southeast Asian Nations were the second largest buyer of Taiwanese exports in August and new orders in August were a record high.

“This can somewhat make up for the blows from exports to China, but China’s supply chain is definitely still stronger than that of Southeast Asia,” Chiu said.

Source: Bloomberg